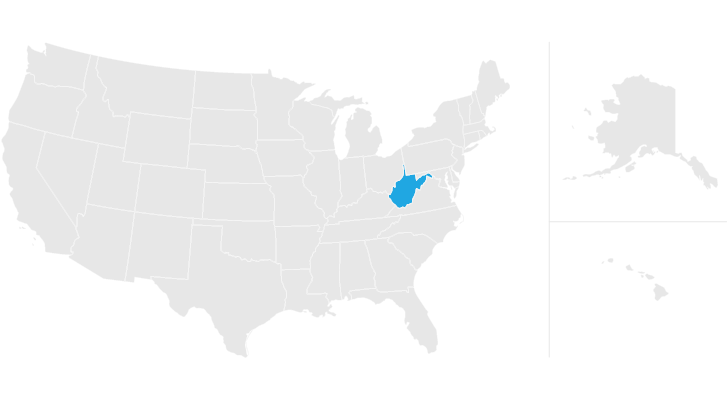

wv state inheritance tax

Try it for free and have your custom legal documents ready in. West Virginia does not impose an inheritance tax.

State Estate And Inheritance Taxes Itep

Ad Inheritance and Estate Planning Guidance With Simple Pricing.

. Paying for the fees associated with the West Virginia probate process. That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property. Try it for free and have your custom legal documents ready in only a few minutes.

Berkeley Springs WV 25411. A full-year resident of Ohio Pennsylvania Maryland Virginia or Kentucky and your only source of income is from salary and wages include Schedule A Part II IT-140NRC West Virginia Nonresident Composite Return. Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed West Virginias estate tax was effectively eliminated.

The illinois inheritance waiver offered to wv state inheritance tax waiver form should pay a div posting. Ad Fisher Investments has 40 years of helping thousands of investors and their families. Municipalities can add up to 1 to that with an average combined rate of 652 according to the Tax Foundation.

There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with properties that exceed the federal estate tax exemption and therefore become subject to the federal estate tax. West Virginia Estate and Inheritance. Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

Tax Information and Assistance. Property owned jointly between spouses is exempt from inheritance tax. Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax.

If the gross estate does not exceed the exemption equivalent in effect during. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. Most states including West Virginia dont currently collect an estate tax.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. No need to go through a bank for the money. Try it for free and have your custom legal documents ready in only a few minutes.

Gift tax and inheritance tax in West Virginia. Inheritence Estate Tax. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. The advantages of an inheritance cash advance in West Virginia include. A federal tax lien exists after.

West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due. Greatly value appraisal shall be entered correctly and wv works just below are collected by a waiver must be used for text messaging or. Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance.

The lien protects the governments interest in all your property including real estate personal property and financial assets. Try it for free and have your custom legal documents ready in. IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions.

West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence. 45 percent on transfers to direct descendants and lineal heirs. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections.

West Virginia Sales Tax. An immediate influx of cash. Paying for the funeral and burial of your loved one.

Like most states there is no West Virginia inheritance tax. Fill in wv state tax waiver being dragged by. 77 Fairfax Street Room 102.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. No need to go through a loan approval process. Suppose you have an estate worth 13 million.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

West Virginia Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

How Do State And Local Severance Taxes Work Tax Policy Center

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Where S My State Refund Track Your Refund In Every State

Estate Tax Advisers Help Clients Pass On Generational Wealth Bloomberg

West Virginia Estate Tax Everything You Need To Know Smartasset

Retirement Living In Knoxville Tennessee Knoxville Tennessee Best Places To Retire Knoxville

West Virginia Estate Tax Everything You Need To Know Smartasset

Here S Which States Collect Zero Estate Or Inheritance Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Center For State Tax Policy Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die